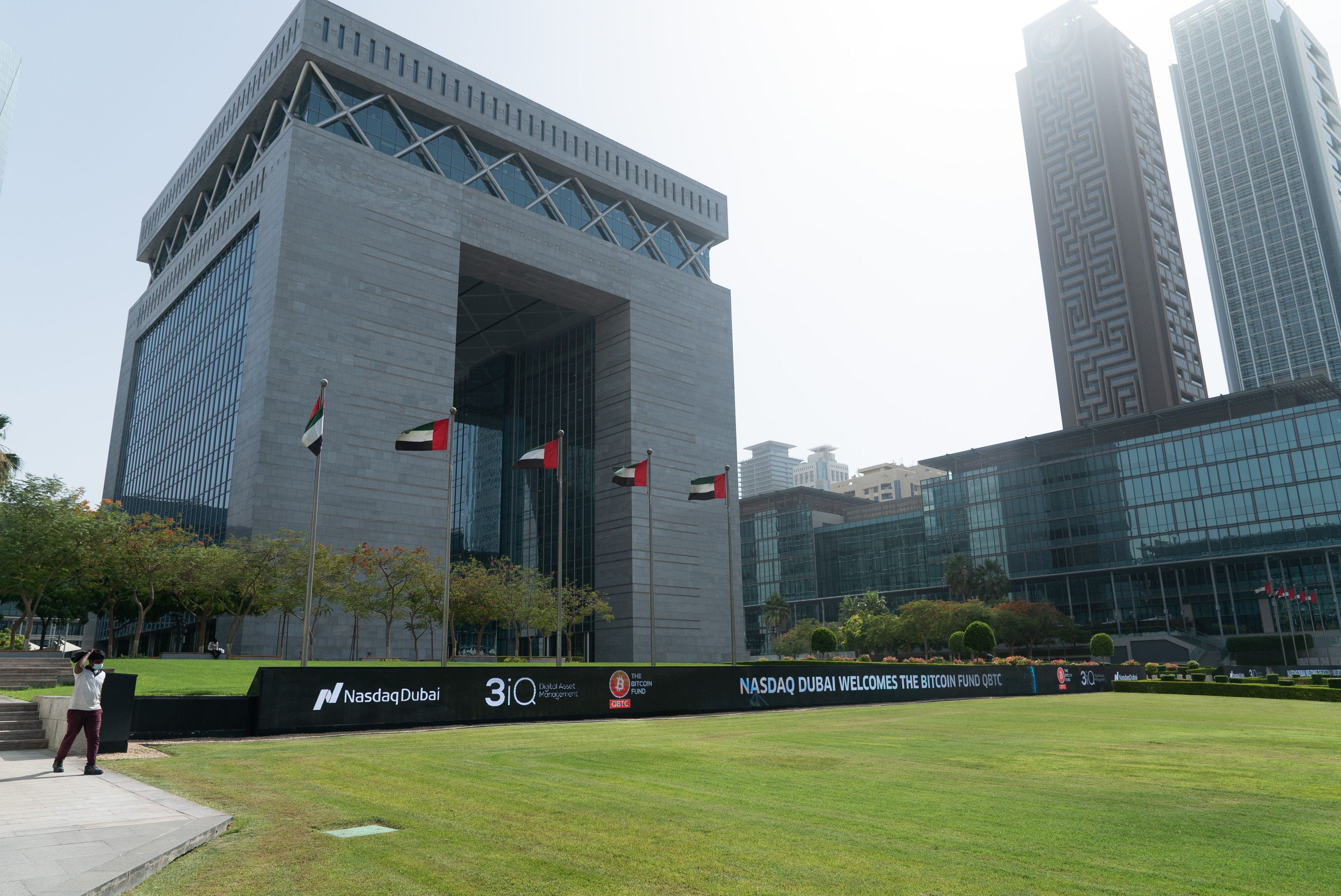

Nasdaq Dubai welcomes the dual-listing of 3iQ’s ‘The Bitcoin Fund’, the first listed digital asset-based fund in MENA

The Fund, from Canada's largest digital asset manager, enables investors to trade its units within a highly regulated and transparent exchange environment

Investors can transfer units of the Fund from the Toronto Stock Exchange to Nasdaq Dubai

Listing reinforces Dubai’s position as a driving force for capital market transformation

Dubai: 23 June 2021: 3iQ Corp., Canada’s largest digital asset investment fund manager with more than C$2.5 billion in assets under management, today officially listed The Bitcoin Fund, (Trading Symbol: QBTC), on Nasdaq Dubai, the region’s international exchange. The regulated Bitcoin-based exchange traded product is the Middle East and North Africa’s (MENA) first listed digital asset-based fund. The listing of the fund, which leverages Dubai’s world-class regulatory environment that supports new economy business and investment growth, reinforces the city’s position as a driving force for capital market transformation.

Managed by 3iQ, the Fund offers investors an indirect exposure to Bitcoin by trading its units within a world-class regulated and transparent exchange environment as well as the opportunity for long-term capital appreciation through a convenient alternative to a direct investment in the crypto currency.

To celebrate the listing, Frederick Pye, Chairman and CEO of 3iQ Corp. rang the Nasdaq Dubai market opening bell in the presence of Hamed Ali, CEO of Nasdaq Dubai and Deputy CEO of DFM, as well as other senior representatives of 3iQ and its advisory firms.

“Our expansion into the Middle East is now official as The Bitcoin Fund has been listed on Nasdaq Dubai as of today. When we launched the Fund in Toronto last year, an expansion into the Middle East was always in the plans and we are extremely proud to have achieved that milestone here today in Dubai. We believe that The Bitcoin Fund is poised to offer tremendous value to regional investors looking to diversify their portfolio with this asset class through a regulated listing,” said Frederick Pye, Chairman and CEO, 3iQ Corp.

The dual-listing of the Fund enables investors to transfer their units from the Toronto Stock Exchange to Nasdaq Dubai (and vice versa) as well as to acquire units directly on Nasdaq Dubai. 3iQ has appointed Dalma Capital and Canaccord Genuity as the joint-lead arrangers for the regional offering of the Fund (subject to regulatory approval). BHM Capital has also been appointed as the Fund’s Liquidity Provider.

Abdul Wahed Al Fahim, Chairman of Nasdaq Dubai, said: “Nasdaq Dubai, a leader in capital market transformation in the MENA region, -is committed to maintaining the highest international standards and best practices for the benefit of market participants. We are confident that our all-inclusive exchange environment places us in an excellent position to attract further listings, whether they are traditional capital markets issuances or alternative investment vehicles.”

Hamed Ali, CEO of Nasdaq Dubai and Deputy CEO of DFM, said: “We are delighted that 3iQ has chosen the robust regulatory framework and enhanced regulations and infrastructure of Nasdaq Dubai as the listing venue for its Bitcoin Fund. This significant step is a push forward for Dubai’s relentless efforts to meet and exceed the evolving needs and requirements of investors, who are looking for seamless accessibility to this new asset class as well as to diversify investment opportunities for investors in the UAE and beyond.”

“We were always confident in The Bitcoin Fund from 3iQ and have seen strong support from key institutions in the region. We remain steadfast in our belief in The Bitcoin Fund as a broader alternative investment vehicle that will offer a more efficient and regulated option for regional investors to access the asset class,” said Zachary Cefaratti, CEO, Dalma Capital.

“Our firm has been part of the journey with 3iQ since inception, in Canada, having led or co-led all of its public offerings on the Toronto Stock Exchange to-date. Today we are proud to be able to partner with them on this landmark moment in the UAE,” said Sachin Mahajan, Head of MENASA, Canaccord Genuity.

3iQ has also appointed a number of other advisors in various capacities to support with the listing; 01 Capital, a London-based corporate finance advisor for the origination and execution of the listing, Razlin Capital a London-based investment firm for advice on the listing, and Pinsent Masons LLP as its legal counsel for the listing process.

Investors keen to learn more about The Bitcoin Fund can visit Nasdaq Dubai on https://www.nasdaqdubai.com or 3iQ at 3iq.ae

About 3iQ: Founded in 2012, 3iQ Corp. (“3iQ”) is Canada’s largest digital asset investment fund manager with more than C$2.5 billion in assets under management. 3iQ was the first Canadian investment fund manager to offer a public listed bitcoin investment fund, The Bitcoin Fund (TSX:QBTC, QBTC.U). 3iQ offers investors convenient and familiar investment products to gain exposure to digital assets. For more information about 3iQ and The Bitcoin Fund, visit www.3iQ.ca or follow us on Twitter @3iQ_corp.

About Nasdaq Dubai: Nasdaq Dubai is the international financial exchange serving the region between Western Europe and East Asia. It welcomes regional as well as global issuers that seek regional and international investment. The exchange currently lists shares, derivatives, Sukuk (Islamic bonds), conventional bonds and Real Estate Investment Trusts (REITS). The majority shareholder of Nasdaq Dubai is Dubai Financial Market with a two-thirds stake. Borse Dubai owns one third of the shares. The regulator of Nasdaq Dubai is the Dubai Financial Services Authority (DFSA). Nasdaq Dubai is located in the Dubai International Financial Centre (DIFC).

About Dalma Capital: Dalma Capital Management Limited is a global alternative investment platform and accelerator focused on alpha generating strategies with an inherent edge in emerging investment strategies and markets. Established in 2011 and headquartered in the Dubai International Finance Centre, Dalma Capital’s goal is to identify the next generation of alpha generating ‘edge’ fund managers, strategies and opportunities. Dalma Capital is authorized and supervised by the Dubai Financial Services Authority (the “DFSA”) under a prudential category 3c license. The DFSA has no responsibility for reviewing or verifying any documents in connection with the Fund and, accordingly, has not approved this document nor taken any steps to verify the information set out herein and has no responsibility for it.

About 01 Capital: 01 Capital is a London based corporate finance boutique. The firm has deep roots in traditional finance coupled with extensive knowledge of the new digital economy and first-hand experience with numerous digital asset projects. 01 Capital’s range of services includes capital markets advisory, corporate finance, network and token economics, fundraising, and consulting.

About Razlin Capital: Razlin Capital is a London-based, FCA regulated boutique investment advisory firm. The Razlin team is comprised of seasoned financial market professionals with backgrounds in Emerging and Frontier Markets sales, trading, investment advisory, deal making, and listing services. Together the team has over 100 years of experience of introducing esoteric and lesser-known capital markets to institutional investors around the globe. Razlin’s focus is to continue to build the bridge between the world of traditional finance and the world of emerging digital assets.

About Pinsent Masons: Pinsent Masons is an international law firm headquartered in London with 26 offices globally. The firm has been in the Middle East for over thirty-five years. Headed by partner Tom Bicknell, the firm’s regional financial services team advises on capital markets, financial regulation, digital assets and fund management.

Media Inquiries: For all media related inquiries, please contact STR8FWD at press@str8fwd.co