Alternative Investment Management Global Platform

The ‘Plug and Play’ Fund Solution

AIMgp is a regulated fund manager, which enables external sponsors to focus on adding value and generating alpha through active portfolio management, knowing that all the operational, regulatory and compliance and fundraising infrastructure is in place to support the fund and their investors.

A lot goes into launching a fund: appointing independent directors, selecting the main service providers (auditor, fund administrator), drafting offering documents, paying for legal counsel representation. AIMgp offers pre-structured `plug and play' fund solutions which allow to save time, reduce complications and keep management company costs to a minimum.

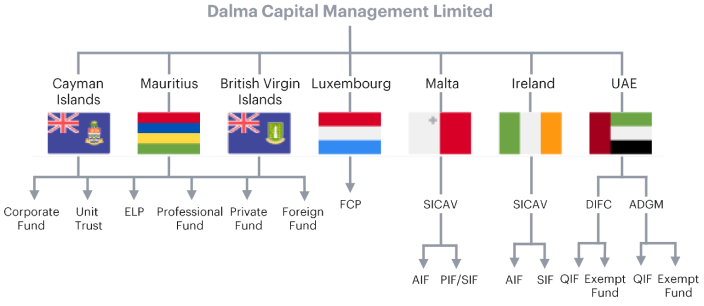

AIMgp offers external managers flexibility in choosing between best-in-class regulatory frameworks. Funds can be established in Dubai International Financial Centre (DIFC), Malta, Cayman Islands, Luxembourg or in various other jurisdictions with a fund structure that best meets the external manager's requirements.

Dalma Capital has established relationships with the best professional service providers in the industry to ensure a smooth startup process and institutional grade service which continues over the lifetime of the new fund.

Key advantages

One-Stop Shop Solution

AIMgp acts as a single point of entry for fund sponsors to set up a fund, build reporting, establish a brand and raise seed capital

Speed to Market

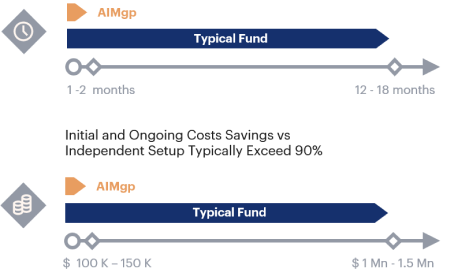

The fund launch timeline is 1 - 2 months. In comparison, establishment of a full fund manager typically takes anywhere between 12 to 18 months

Cost Savings

The cost equivalent is less than 10% of establishing an independently regulated fund manager and fund

Help with Marketing and Distribution

Dalma Capital is a well-established and trustworthy brand. AIMgp is able to offer an established distribution network and the potential for introductions to new sources of capital

Responsibility for Compliance and Corporate Governance

AIMgp takes primary responsibility for a significant portion of the on-going compliance, regulatory and corporate governance requirements inherent in the post-launch operations. This essentially frees the manager to focus on actual portfolio management

Know-How

Managers are able to draw on an established team with experience of alpha generation, good processes, and continuity. Managers also obtain access to the platform managers’ general know-how regarding the launch process and product specifics as well as local market knowledge

AIMgp services

1. Core Platform Services

The AIMgp provides next-generation solutions towards starting alternative investment funds.

2. AIMgp Accelerator

AIMgp Accelerator supports talented portfolio managers through all phases of growth from inception to scale.

AIMgp Accelerator backs exceptional talent in three ways – providing access to its institutional infrastructure, accelerating growth and raising capital.

AIMgp Accelerator builds strategic partnership with managers by offering unique independence and continues support to build their own brand, grow their teams and increase AUM.

AIMgp Accelerator connects the best portfolio managers and forward-thinking investors. Dalma Capital is uniquely positioned to support exceptional managers to accelerate growth and gain traction. Dalma offers both seed and accelerating capital to selected fund managers.

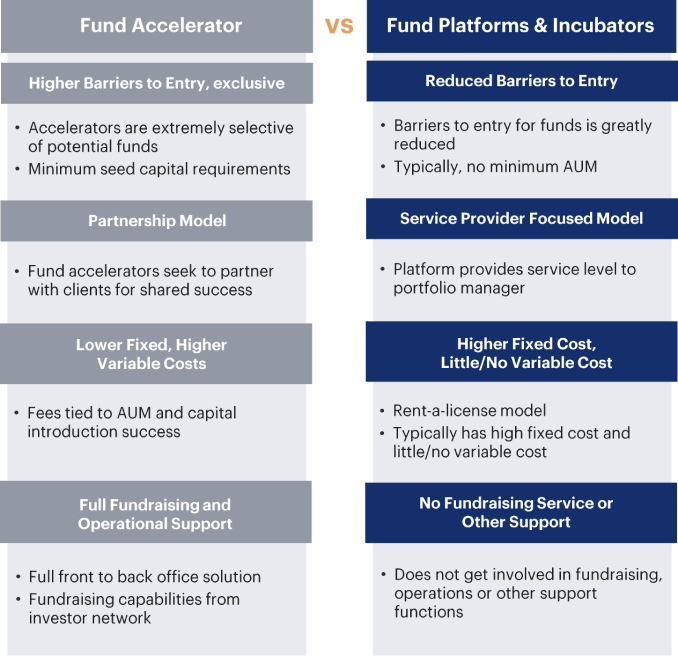

3. Accelerators are Different from Platforms and Incubators

Having emerged from Platforms, Accelerators seek to do a lot more. In addition to offering a full accelerator platform, Dalma Capital offers basic platform services acting as a DIFC ManCo and AIFM platform, whilst offering a more comprehensive 'accelerator' solution for sponsors seeking assistance with fundraising, legal support and operations.

Fund Set-Up

1. Launch a Fund in Reduced Time and at Lower Cost

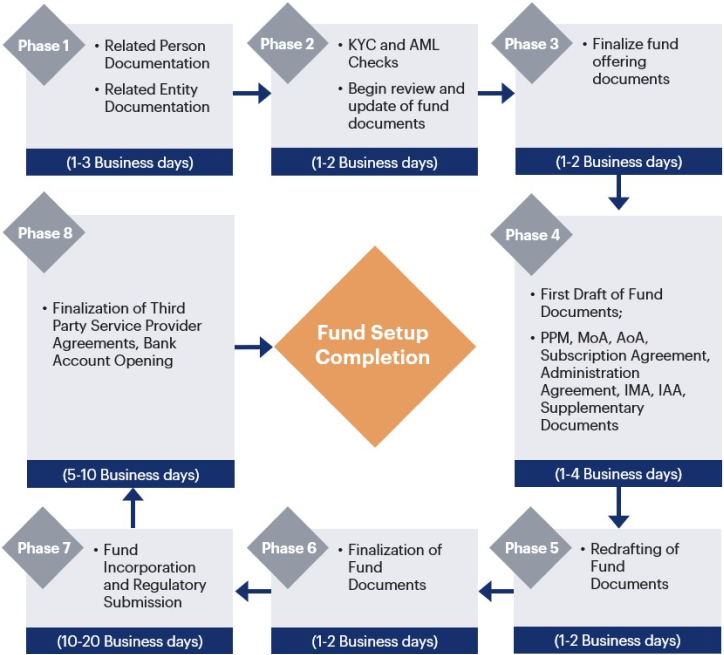

Launching a new fund can be a difficult undertaking, choosing the right jurisdiction, working with legal counsels, finding credible service providers and coordinating between all counterparties. AIMgp solves this, by offering a robust, efficient and turnkey fund solution equipped with world-class operational infrastructure. AIMgp helps fund managers to setup their independent fund structures, on board tier one service providers, and overcome compliance and operational challenges and costs.

2. Indicative Fund Onboarding Timeline

Regulatory Compliance

Fulfill All Compliance Requirements

By appointing Dalma Capital as a Fund Manager, a solution is provided for multi-jurisdictional compliance.

AIMgp helps fund managers to structure and setup investment vehicles across multiple jurisdictions. Dalma Capital’s extensive knowledge in the industry and its partnership with the leading legal firms gives the new funds an exceptional advantage. In addition to licensing benefits, Dalma Capital takes the tedious, costly and time-consuming tasks required for initial and ongoing compliance off the managers hands. Dalma Capital will reshape the procedures in-line with regulatory requirements.

Dalma Global Platform infrastructure enables an external investment team to efficiently manage their specific fund structure that is best for their strategy.

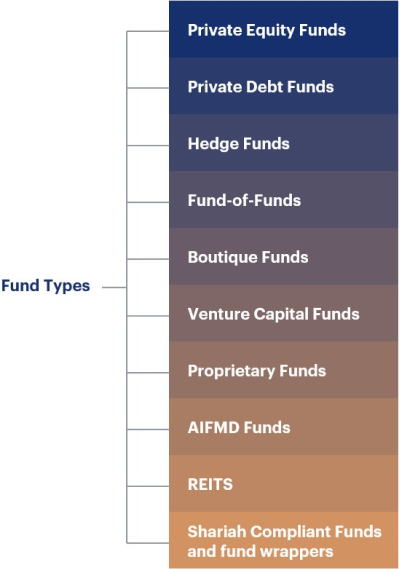

The platform is set up to manage open or closed-ended funds:

DIFC Platform

Managing Assets from the DIFC

The Dubai International Financial Centre (DIFC) is a gateway for capital and investment, strategically located between East and West. Filling the time-zone gap between the leading financial centres of New York and London in the West and Hong Kong and Tokyo in the East, DIFC is a platform for access regional wealth and investment opportunities and global asset management.

The DIFC in a unique jurisdiction for asset management activities in that it enjoys both onshore and 0% tax status.

AIMgp allows portfolio managers to take advantage of the benefits of the DIFC with an institutional operational, financial, technological, investor relations, legal and compliance infrastructure.

Unique Onshore, Tax Free Status

DIFC – The Leading Financial Centre in the Middle East

DIFC offers fund managers an efficient, zero tax-rate business environment operating to international regulatory standards

DIFC’s fund framework provides class-rivalling costs and time-to-market, with globally competitive minimum capital requirements

There are no remuneration restrictions on fund managers

DIFC is rated to be one of the world's leading FinTech jurisdictions with a flourishing ecosystem and with the world's second most active FinTech regulatory sandbox

Conveniently positioned globally at the crossroads of major trading routes, Abu Dhabi is in close proximity, mostly within a three hour flight, to the two large wealth markets in the wider Middle East and Indian Sub-Continent

DIFC offers a full ecosystem of legal, accounting and servicing firms and enables the optimisation of businesses

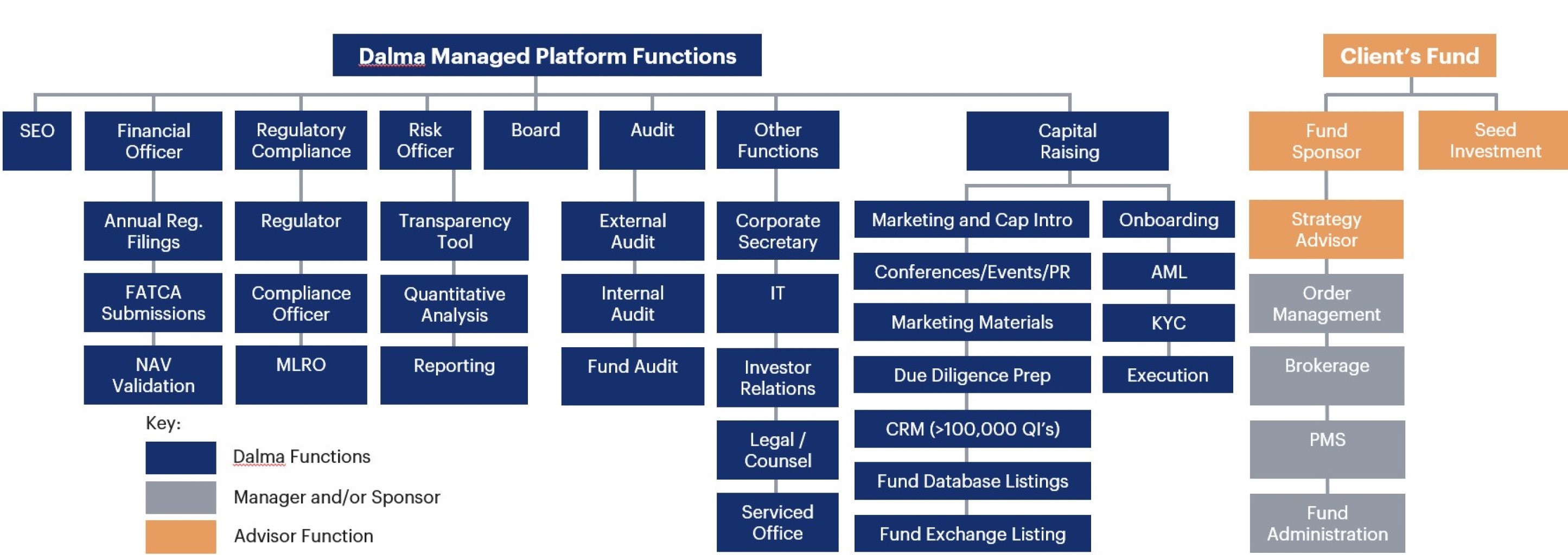

Complete Front-To-Back Office

Manage Operations More Efficiently

AIMgp offers a complete front-to-back office support including compliance oversight and risk monitoring.

AIMgp helps to reduce any administrative burden by providing a wide array of integrated services.

AIMgp provides access to the existing operational infrastructure and counterparty relationships.

Platform Functions

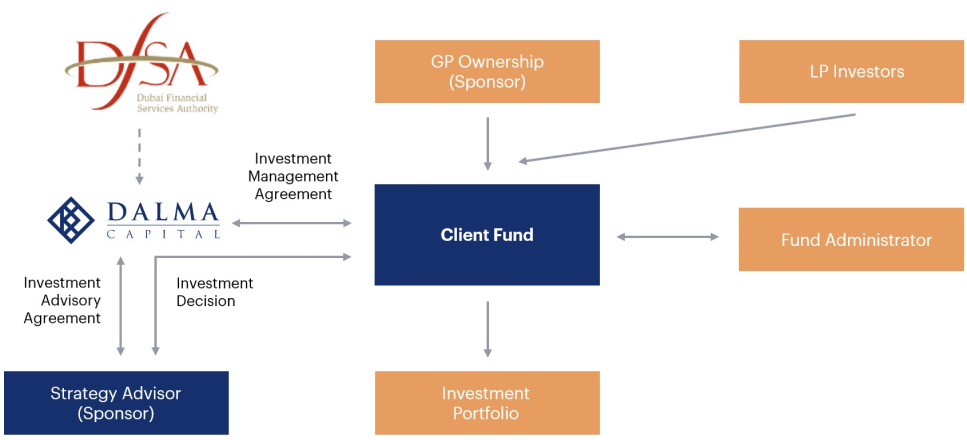

Typical Fund Structure

The following is an example of a typical fund structure, though each fund on the platform can be customized. Dalma Capital enables the manager to retain ownership of the fund and track record, while providing regulated “ManCo” Infrastructure.

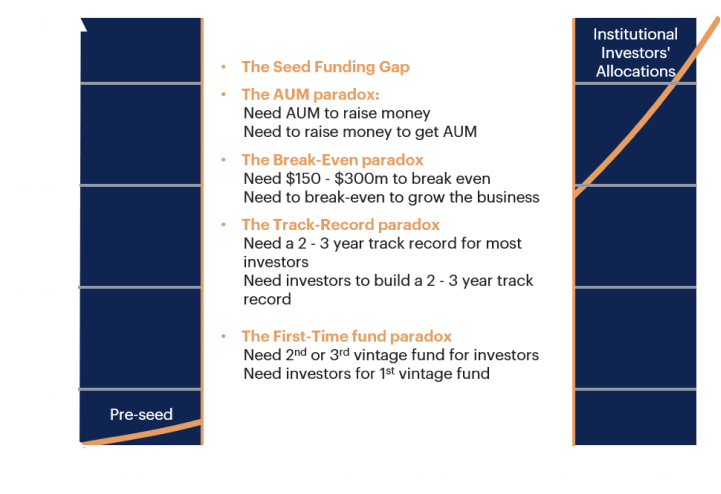

Fundraising environment

In a challenging fundraising environment, gaining seed and critical mass prove to be even more difficult.

Dalma Capital’s Platform helps funds surpass the AUM paradox and first fund limitations keeping many investors out.

Dalma Capital provides a solution where firm AUM meets requirements, portfolio managers can break-even with limited AUM and funds are not necessarily ‘first time’ funds.

Dalma has also developed a network of investors who are comfortable with smaller, newer funds on our platform.

Changing Sources of Capital

The Changing Investor Map

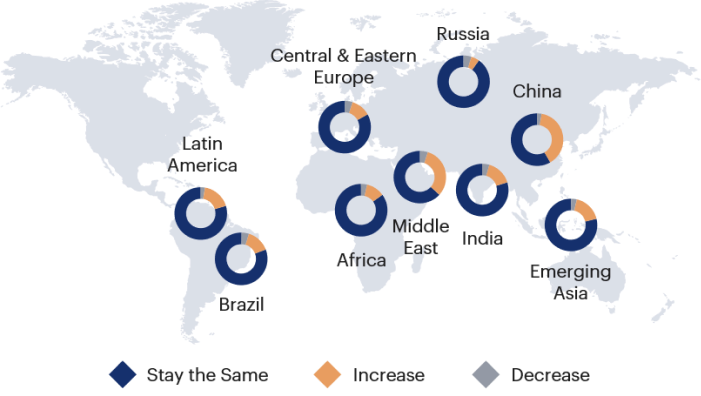

Capital sourcing is shifting towards Emerging Markets. Fund managers expect Middle East and China to lead global growth as a source of capital. UAE is strategically located for fundraising from the Middle East and Asia.

Fund Managers’ Projected Change in Level of Capital Sourced from Emerging Markets by 2023

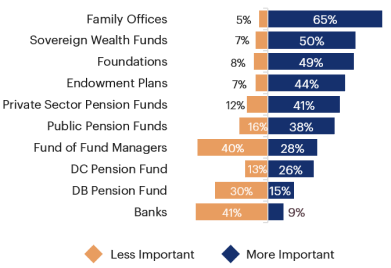

Allocators In 2023

High-net-worth private clients are shifting towards alternative investments for diversification, the benefits that come from a non-correlation to other investments within their portfolio, as well as potential inflation-hedging. Dalma Capital’s penetration with Family Office investors helps managers raise capital in early stages.

Fund Manager Views on Investor Types as Sources of Capital in 2023

Source: Preqin Fund Manager Survey, June 2018

Dalma’s Capital Introduction Services

Access to over 135,000 institutional investors *

Participation and representation at global events, including AIM Summit

Reporting to 20+ investor subscribed databases

Brand consulting, pitch books, DDQs

Efficient Onboarding, KYC and AML & Reporting

Stock Exchange Listings

Compliant approach to fund distribution

*Only available to funds with over $10m AUM.

Dalma Capital is a strategic partner and primary sponsor of the AIM Summit, the largest conference for Alternative Investments in MENA and growing internationally.

Dalma Capital provides a platform within the AIM Summit for the fund to launch and market its offering, providing instant visibility among institutional investors.

AIM Summit welcomes over 1,000 investors and investment managers overseeing over $10 trillion

AIM Events are held in the top global and leading regional financial centers: Dubai, Abu Dhabi, Geneva, Mumbai and London.

Enhanced Capital Introduction

Dalma Capital offers fund managers and investors a targeted approach to Capital Introduction. Maintaining long-standing relationships with hedge funds and investors, Dalma’s team understands the respective goals of each and help facilitate meaningful introductions.

In order to help fund managers to increase marketing effectiveness so they can focus on managing their business, Dalma provides its "Standard Capital Introduction" service package to all funds as part of the existing agreement*.

As a value-added service Dalma Capital offers “Enhanced Capital Introduction” service, which goes above and beyond standard capital introduction package, to help managers to distribute their story even more effectively and maximize their visibility in the marketplace.

| Standard Capital Introduction* | Enhanced Capital Introduction** | |

|---|---|---|

| Only available to funds with $10m AUM or more | ||

| Management of investor meetings, interest, follow-up, onboarding and closing | ||

| Cross selling of fund alongside Dalma suite of funds to Dalma contacts | ||

| Complimentary invitations to all AIM Summit conferences for fund manager and 3 guests ($15k/year value) | ||

| Benefit from Dalma’s access to over 110,000 prospective investors | ||

| Brand consulting and pitch book preparation included in onboarding | ||

| Basic fund page on Dalma website | ||

| Compliance management by Dalma Capital for distribution and fundraising efforts | ||

| Bespoke and dedicated investor roadshows, focused exclusively on your fund | ||

| Weekly update meetings with fundraising team, quarterly reports | ||

| Registering fund on 2 or more leading database platforms | ||

| Introduction and onboarding management of fund to IFAs, private banks (where possible) | ||

| Registering fund on open-architecture platform (eg. Allfunds), where possible | ||

| Automatic AIM Summit sponsorship x2 events per year ($30k/year value) | ||

| Dedicated investor event organization once per year with investor invitations*** | ||

| Fund email blast (once per quarter) | ||

| Fund DDQ preparation | ||

| Fund data room setup for investor due diligence, with tracking, security and access control | ||

| Login access to proprietary CRM with over 180,000 contacts | ||

| Seed capital introduction (where possible) |

* Free of charge and is included as part of the existing agreement (subject to minimum fund size of $10m)

**Chargeable service

***Chargeable at cost +30% for project management and services

Onboarding Approach

AIMgp Accelerator looks for Alpha Generating Managers and “Edge Funds”

Dalma Capital believes that having an edge is the one consistent factor for outperforming managers across asset class, strategy and geographies. An edge exists because a market is dislocated or inefficient, the portfolio managers are first class and the strategy is well designed and differentiated.

AIMgp Accelerator works with those managers who can demonstrate a durable edge in their market or strategy, is expected to generate alpha, and who typically have spun out of an institution or who have managed a private portfolio (i.e. family office) which they are seeking to institutionalize with third-party capital.

Selection Criteria

Have an “edge”

Market is inefficient or dislocated

Strong Investment thesis

Investment thesis is sound, well-articulated and is strategy aligned with inefficiency capture

Fund is differentiated

AIMgp Accelerator targets differentiated investment strategies on niche markets

Best of Breed Portfolio Managers

AIMgp Accelerator looks for alternative investment portfolio managers (hedge fund, private equity, private debt, VC or Niche) with a top quartile or top decile track record

Pre-seed capital

Managers expect or have secured capital commitments of at least $10m for seeding the fund, and are putting their own ‘skin in the game’.

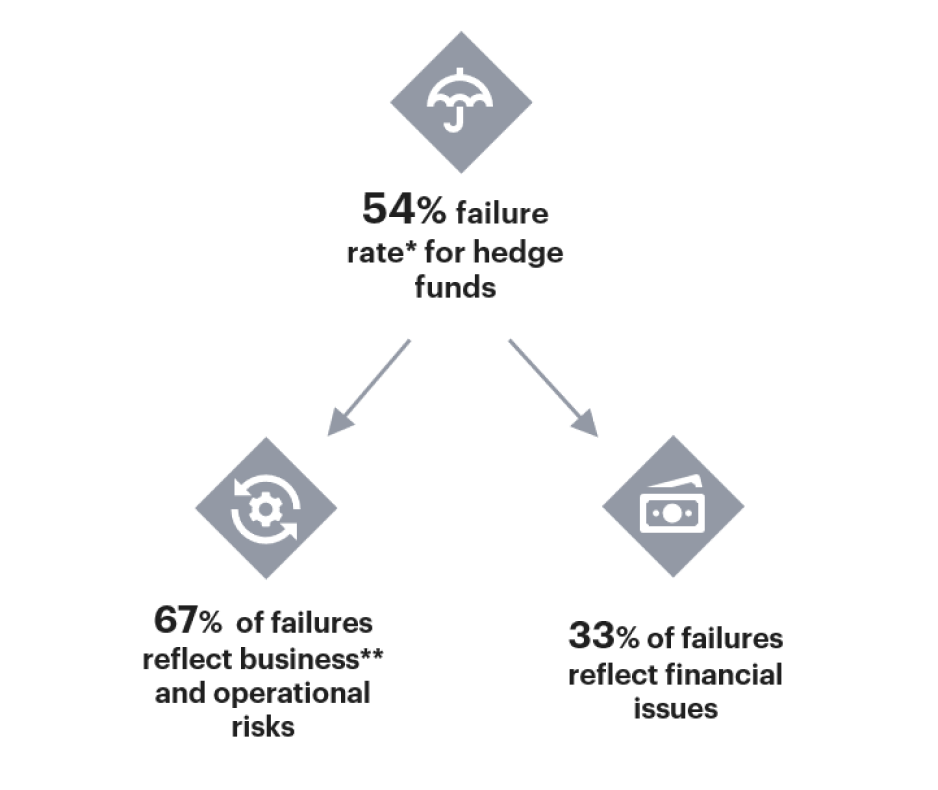

Key Reasons Behind the Hedge Fund Failure

*Failure rate includes only firms established more than 2 years prior to December 2018, assuming firms with less than 2 years of operations have not had sufficient opportunity to succeed or fail.

**Fraud is classified as a business risk.

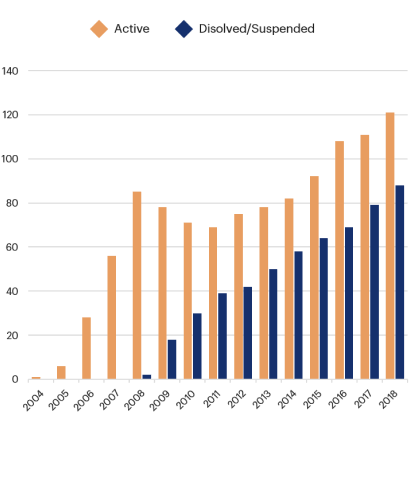

DIFC Fund Managers, Active vs Dissolved

Source: Dalma Capital Research on DIFC Fund Managers: DIFC Public Registry, DFSA Public Registry, CAIA association

Fund Platforms Reduce Risk of Failure

Platforms solve each of the major issues causing most firms to fail, and investors to be wary of emerging managers.

Financial Risks

Third-party fund platform is a large well-established diversified organization with adequate resource allocation. It ensures the financial stability of the hedge funds by cutting overhead costs and reducing break-even point by 90%.

Operational Risks

Resources of platform ensure robust operational systems and controls in compliance, legal, finance, and other operational functions. To avoid intentional misrepresentation, the platform oversees valuation methodologies and ensures proper controls.

Business Risks

Fund Platform prevents and detects possible misuse of funds and unauthorized trading. In order to ensure appropriate checks and balances, each fund is oversight by the board of directors and independent audits.

Management Risks

Platform enables investment managers to focus on active portfolio management, knowing that all the operational, regulatory and compliance and fundraising functions are serviced adequately and independently.

Platforms reduce break-even point by 90%

It takes at least $150-300 million in assets for a hedge fund to be self-sustaining on its management fees alone, while the largest hedge fund firms incur significant additional costs due to complexity and size. Platforms reduce break-even point for the hedge funds by 90%, to $15-$30m.

$150-300 m AUM Needed by

Stand-Alone Funds to Break Even

$15-30 m AUM Needed by

Umbrella Funds (funds of third-party

platforms) to Break Even

The real minimum paid-up capital of a hedge fund is not less than $2 million

94% failure rate for funds with ‘regulatory minimum capital’ requirements

54% failure rate overall