A World of Contrasts

- US economic data regains strength after recent loss of momentum

- Fed meets this week but is unlikely to move policy or alter its messaging to the markets

- European economic data is weak and gives ECB room to make an earlier-than-expected cut in interest rates

- El Nino creates potentially large problems for the normal operation of the Panama Canal – a potential problem for the US economy

After a few weeks of disappointment, US economic data changed the trajectory for the better, challenging the market view that US growth was rolling over and the Fed should resort to interest rate cuts sooner. Both the US employment numbers and the US consumer confidence survey came in better than expected. The November US employment report showed non-farm employment growth of 190,000, which was more substantial than expected. Hours worked per week and wage growth were stronger, too.

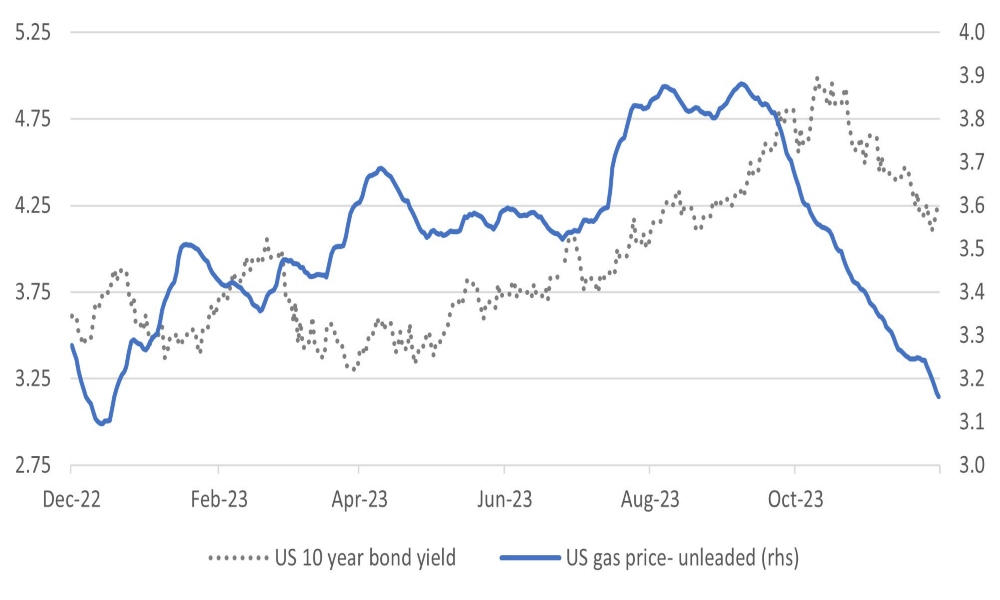

The sharp increase in the University of Michigan’s Consumer Confidence Index to 69.4 (against the consensus of 62.0) suggests that the recent drop in inflation and long-term interest rates may have prompted consumers to feel more confident about life. As we have been emphasising in recent CIO weeklies, aggregate monetary conditions have loosened significantly with the drop in long-term interest rates and the sharp rally in the equity market. Consumers will also note that the average gas price has dropped, which is a sign that consumer spending could reaccelerate from here. At 69.4, the headline level of confidence was way above expectations. The confidence level is still low by historical standards but has recovered from the lows seen during the middle of last year.

Chart 1: Consumer sentiment helped by drop in fuel bill and long-term interest rates

Source: Bloomberg

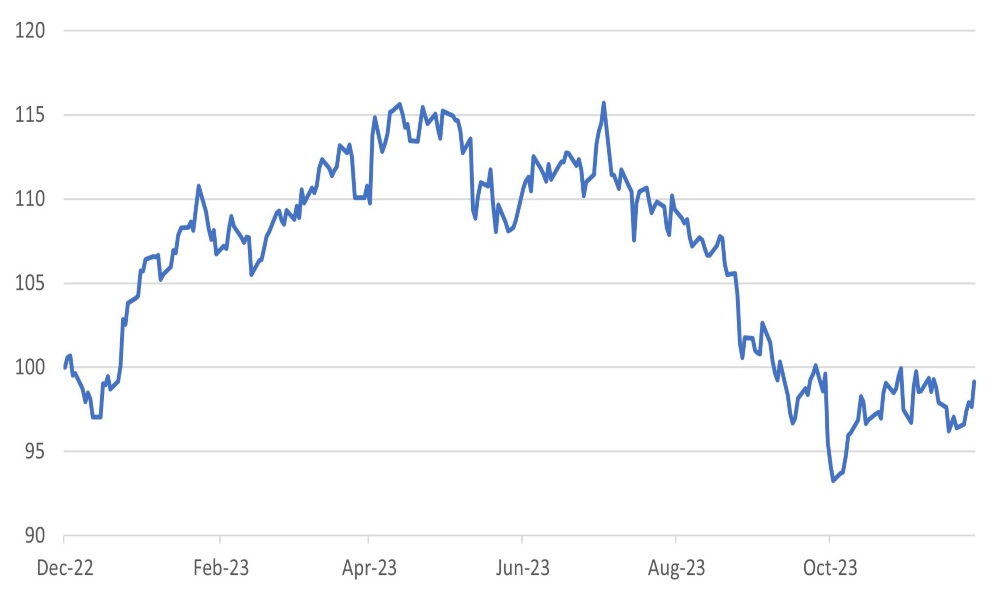

It's worth noting here that US economic data had been on a downtrend even until last week. The US Citigroup economic surprise index, for instance, had weakened to an index level of 11.7 from 80 before it rebounded to 20 last week. The strong absolute gains in the US equity market look even more extraordinary in the context of such a weakening of the economy.

Chart 2: US CESI Economic Surprise Index

Source: Bloomberg

The Federal Reserve's monetary committee meets this week. The market, though, is not expecting any fireworks, with no change in policy seen. However, the market will scrutinise every word of the statement and the press conference that follows. While any firework is ruled out, the market will likely be hoping for a message that at least helps keep the current rally intact. Nevertheless, we struggle to see how the Fed could endorse such a move higher in bonds and equities when the medium-term strength of economic data is unclear.

We will get another part of the puzzle of how the markets will close out the year with this week’s US CPI report. Core inflation ex-food and energy is expected to remain unchanged at 4.0% year-on-year. The bias of risks is probably to the downside given the softness of product prices around the world and lower-than-expected CPI reports from China and Europe. However, even a surprise to the downside is priced into long bonds.

Eurozone’s weakness – ECB to act early?

The strength in US economic data is in stark contrast with the weakness in the eurozone. Unlike the Fed, the ECB may have fewer choices and may need to act early. Such a move, if it materialises, will help selective sectors in the market, such as consumer stocks. Last week's eurozone GDP report was in line with expectations, showing a contraction of 0.1% quarter-on-quarter of the economy. Earlier in the week, the retail sales report missed expectations, showing further contraction in retail sales. However, many economists expect eurozone retail sales to improve as persistent real wage growth supports a recovery in consumer spending. The weak GDP data may also prompt an earlier move by the ECB to cut rates. The market prices a likelihood of five rate cuts by the end of next year.

Chart 3: The relative performance of European consumer durables relative to European equities

rebased to Dec 2022=100

Source: Bloomberg

Logistical challenges: We have had COVID and wars and now we have canals at risk

We note that analysts are increasingly concerned about the potential disruptions to the two vital links in the world of global logistics – the Panama and Suez canals.

The Panama Canal, a crucial conduit for international maritime trade, faces significant challenges because of fluctuating water levels. The impact of El Niño, the worst on record, has been so severe that it has led to the lowest water level in the canal since 1951. The authorities have for the first time reduced the number of crossings. Month-to-date passages are down 30% with further reductions expected in the coming months. The problem is not just the number of ships that can pass through the canal per day but also the need for these vessels to carry comparatively lighter loads. On average, the ships are operating with at least 40% truncated capacity. That is quite a lot considering 40% of all US container traffic passes through the canal every year. While the Suez Canal does offer an alternative, there are concerns that the Yemeni Houthis will attack shipping in the Red Sea. Israeli shipping has been particularly at risk.

Copyright © Dalma Capital, All rights reserved.

This document is being provided for information purposes only and on the basis that you make your own investment decisions; no action is being solicited by presenting the information contained herein. The information presented herein does not take account of your particular investment objectives or financial situation and does not constitute (and should not be construed as) a personal recommendation to buy, sell or otherwise participate in any particular investment or transaction. Nothing herein constitutes (or should be construed as) a solicitation of an offer to buy or offer, or recommendation, to acquire or dispose of any security, commodity, or investment or to engage in any other transaction, nor investment, legal, tax or accounting advice.

The information contained herein is not directed at (nor intended for distribution to or use by) any person in any jurisdiction where it is or would be contrary to applicable law or jurisdiction to access (or be distributed) and/or use such information, including (without limitation) Retail Clients (as defined in the rulebook issued from time to time by the Dubai Financial Services Authority). This document has not been reviewed or approved by any regulatory authority (including, without limitation, the Dubai Financial Services Authority) nor has any such authority passed upon or endorsed the accuracy or adequacy of this document or the merits of any investment described herein and accordingly takes no responsibility therefor.

No representation or warranty, express or implied, is made by Dalma Capital Management Limited (“Dalma”) or its affiliates as to the accuracy, completeness or fairness of the information and opinions contained in this document. Third party sources referenced are believed to be reliable but the accuracy or completeness of such information cannot be guaranteed. Neither Dalma nor any of its affiliates undertakes any obligation to update any statement herein, whether as a result of new information, future developments or otherwise.

This document contains forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on current beliefs, expectations and assumptions regarding the future of the relevant business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Dalma’s and/or its affiliates’ control. Actual results and financial conditions may differ materially from those indicated in the forward- looking statements. Forecasts are based on complex calculations and formulas that contain substantial subjectivity and no express or implied prediction made should be interpreted as investment advice. There can be no assurance that market conditions will perform according to any forecast or that any investment will achieve its objectives or that investors will receive a return of their capital. The projections or other forward-looking information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future investment results. Past performance is not indicative of future results and nothing herein should be deemed a prediction or projection of future outcomes. Some forward looking statements and assumptions are based on analysis of data prepared by third party reports, which should be analysed on their own merits. Investments in opportunities such as those described herein entail significant risks and are suitable only to certain investors as part of an overall diversified investment strategy and only for investors who are able to withstand a total loss of investment.