Ten Pointers to 2024

As we step into a new year, it's crucial to understand the evolving landscape of financial markets. We look back to draw lessons and try to gauge what can be set right. We dwell on the happenings of the year gone by and try to understand what can go right – and wrong – for the markets. Below, we present ten pointers on how the markets fared and where we think we are headed.

- 2024 – A year of modest growth and lower interest rates

Looked at purely from the point of view of a simple macroeconomic outlook, asset prices in 2024 should experience some positive returns. While we do not see the Fed cutting interest rates early, the prospect of lower rates should keep the markets in a constructive frame of mind.

- 2023 was exceptional, as much as 2022 was terrible; 2024 should be more ‘normal’

Market commentators have made a good deal out of the 'great' returns that markets experienced in 2023, but much of these were just a reversal of the misfortunes of 2022. The two years taken together do little in terms of offering an insight into trend returns from markets.

- Emerging markets to outpace developed markets…again.

The words ‘emerging markets’ are evermore evidently a wrong descriptor of the high-growth markets of the global economy. In 2024, the IMF forecasts emerging markets to grow 4.0% versus a not-so-impressive 1.4% expected for the developed markets. In the growth markets, interest rates should see a more rapid decline, and their currencies should perform well against the dollar. The balance sheet of many growth economies remains in relatively good shape when compared with those of the debt-fuelled Western economies.

- Why risk underweighting the tech sector?

While we fully understand investors' concerns about the (rich) valuations of many tech stocks, we wonder if it would be wise to underweight a sector that could see its fortunes turn as the rollout of AI capabilities across the industry gathers seismic pace. Industry estimates forecast a compounded growth rate of more than 70% in generative AI solutions between 2023 and 2027.

- Be strategic, not tactical

We continue to warn investors to not spend too much time guessing or worrying about the Fed’s next move. We advise relying on strategic thinking to shape asset allocation in portfolios. It has become a mug game to second-guess what the Fed is up to next…which even the Fed doesn’t seem to know! The quite extraordinary way asset prices rallied as the year closed only underlined the risk of betting on the Fed's last statement – they reserve the right to change their mind…often!

- Alternative assets still deserve their significant place in portfolios

After a year of good returns from equities and bonds, it is understandable and perhaps undeniable that investors will assess the merits of holding less liquid alternative investments, or those like hedge funds with less transparency around the source of their returns. However, even as we emphasise that liquid assets did well in 2023 after a very poor 2022, alternative investments provided much more consistent returns when we combined the two years together. We advise maintaining exposure to alternative investments for their diversification benefits and less volatile returns overall.

- Geopolitics remains a dangerously large risk

We still have two significant theatres of war, which are not improving. Indeed, many still see the risk of a significant escalation for the worse. Come spring, Russia could make more significant territorial gains in Ukraine without better support from the West for the latter. Meanwhile, should Iran become more involved in the conflict in the Middle East, it risks setting off a chain of events that no one wants to contemplate.

Half of the world population will go to polls in 2024, with the outcome of the US Presidential election having the most significant impact on the world economy and politics. For much of 2024, we will be sitting and pouring over court battles and opinion polls. The gap between the two likely presidential candidates is so stark. The consequences of a new Trump administration are frightening to many, given the perceived extremity of many of the proposed policies.

- China – too big to ignore

China, as the second largest economy in the world, just can't be ignored even if 2023 was a real disappointment. Chinese asset markets remain a key element of some of the major indices. While some asset managers have increasingly pressed for ex-China mandates, many of the major global stocks depend for their growth on a vibrant Chinese economy, Chinese buyer or Chinese supplier. Chinese equities remain on our buy list because the 20-year low valuation discounts much of the bad news, and things are improving with authorities incrementally providing support for the economy. The Chinese economy will likely grow 4-5% this year.

- Inflation will remain key to market mood

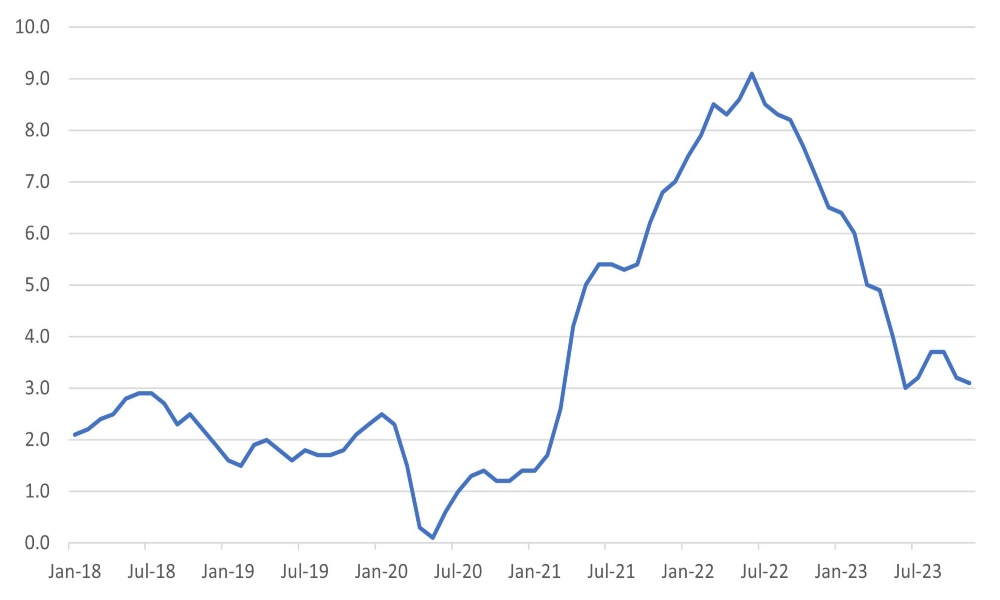

It is no slam dunk that global inflation will gradually ease to what many central banks have long contemplated, but typically it will be around the 2% level. Geopolitics could still spoil the game and push commodity prices higher. Wage growth is still relatively strong, with labour seeking to cover the loss of real incomes in recent years. Climate change has the power to be a significant disruptor to crop yields. Although inflation pressure has abated, we suspect it may linger longer than the market's current price.

US Inflation is down but not out

Source: Bloomberg

- Buy the value or the good stories

At the end of last year, there was a sense that investors were seeking better value in markets. Indeed, it was significant that the Dow Jones 30 managed to keep pace with NASDAQ in terms of returns in the year's closing months. Beaten-up sectors such as REITs have started to perform better. There is apparent value in China, as we have already mentioned, and indeed across Asia. One story we would want to stay with and focus on is India. While some investors bemoan the high valuations, there is still such good momentum in the economy and a likely favourable outcome to the nationwide general elections this year.

Copyright © The Global CIO Office, All rights reserved.

This document is being provided for information purposes only and on the basis that you make your own investment decisions; no action is being solicited by presenting the information contained herein. The information presented herein does not take account of your particular investment objectives or financial situation and does not constitute (and should not be construed as) a personal recommendation to buy, sell or otherwise participate in any particular investment or transaction. Nothing herein constitutes (or should be construed as) a solicitation of an offer to buy or offer, or recommendation, to acquire or dispose of any security, commodity, or investment or to engage in any other transaction, nor investment, legal, tax or accounting advice.

The information contained herein is not directed at (nor intended for distribution to or use by) any person in any jurisdiction where it is or would be contrary to applicable law or jurisdiction to access (or be distributed) and/or use such information, including (without limitation) Retail Clients (as defined in the rulebook issued from time to time by the Dubai Financial Services Authority). This document has not been reviewed or approved by any regulatory authority (including, without limitation, the Dubai Financial Services Authority) nor has any such authority passed upon or endorsed the accuracy or adequacy of this document or the merits of any investment described herein and accordingly takes no responsibility therefor.

No representation or warranty, express or implied, is made by Dalma Capital Management Limited (“Dalma”) or its affiliates as to the accuracy, completeness or fairness of the information and opinions contained in this document. Third party sources referenced are believed to be reliable but the accuracy or completeness of such information cannot be guaranteed. Neither Dalma nor any of its affiliates undertakes any obligation to update any statement herein, whether as a result of new information, future developments or otherwise.

This document contains forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on current beliefs, expectations and assumptions regarding the future of the relevant business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Dalma’s and/or its affiliates’ control. Actual results and financial conditions may differ materially from those indicated in the forward- looking statements. Forecasts are based on complex calculations and formulas that contain substantial subjectivity and no express or implied prediction made should be interpreted as investment advice. There can be no assurance that market conditions will perform according to any forecast or that any investment will achieve its objectives or that investors will receive a return of their capital. The projections or other forward-looking information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future investment results. Past performance is not indicative of future results and nothing herein should be deemed a prediction or projection of future outcomes. Some forward-looking statements and assumptions are based on analysis of data prepared by third party reports, which should be analysed on their own merits. Investments in opportunities such as those described herein entail significant risks and are suitable only to certain investors as part of an overall diversified investment strategy and only for investors who are able to withstand a total loss of investment.